The MINEX Eurasia 2025 conference, held on 1 December 2025 at Simmons & Simmons in London, delivered a high-impact programme focusing on the strategic significance of Central Asia’s mineral resources in the global market.

The event showcased investment initiatives, advancements in FDI policies, and industrial development targeting productivity, reduced environmental footprint, and durable community ties.

The conference’s six main sessions provided a comprehensive review of the geopolitical, economic, and technological forces shaping the Eurasian extractive sector.

The discussions were focused on the geopolitical and economic forces shaping the extractive industries across Eurasia, with a clear emphasis on critical minerals and energy transition realism.

- Central Asia’s Role: The opening session positioned Central Asia’s vast reserves as a globally contested arena for critical minerals, essential for the global energy transition. The region is at the intersection of economic opportunity and geopolitical strategy.

- Geopolitical Strategy: Experts explored the complex interplay of international investment (EU, China, US, UK), local governance, and the political momentum driving the sector, providing a crucial understanding of the risks and rewards of engaging in this strategically vital region. The UK’s roadmap for strategic cooperation and the OECD’s work on critical minerals development was specifically highlighted.

- Kyrgyzstan’s Keynote: The conference featured a major keynote address from H. E. Meder Mashiev, Minister of Natural Resources, Ecology and Technical Supervision of Kyrgyzstan, outlining the country’s strategy for the critical minerals sector.

- The “Energy Quadrilemma”—balancing cost, carbon, security, and water—was a core theme, exploring how Eurasian states are strategically balancing immediate reliance on fossil fuels (like coal) with the future potential of nuclear power and renewable infrastructure.

- The discussion focused on the geopolitical and economic consequences for the extractive industries, including the accelerated development of deposits critical for both fossil fuel stability and the global clean energy transition (uranium, lithium, rare-earth).

- Sessions addressed the need for capital to drive the global energy transition. Leaders from the London Stock Exchange, EBRD, AIFC, KfW IPEX-Bank, Oval Advisory, Xcelsior Capital and IFC participated in panel discussions on Capital Markets’ Response and Mining Project Finance and Investment.

- A dedicated session on Kazakhstan Mining Outlook 2026 covered rapid industry transformation, key drivers, investment trends, and major projects shaping geological exploration and critical mineral development.

- Project Showcase: Steven McRobbie, VP Projects Development at IG Asia, presented a deep dive into the company’s work on the Pribrezhniy Copper Porphyry Deposit in Kazakhstan, detailing its potential and development pathway.

- Exploration Strategy: Robert Barlow, Corporate Development Analyst at Ivanhoe Mines, outlined the company’s approach to discovery, emphasizing “A fresh approach to discovery” in the region.

This Fireside Chat focused on the urgency of the 21st-century materials race, which extends far beyond the dominance of rare earths.

- Securing Supply Chains: The core challenge is securing access to a diverse range of critical materials while minimising geopolitical vulnerabilities.

- Risk Mitigation: Discussion centred on the need to diversify sources and reduce dependence on any single country, as well as the risk posed by potential export restrictions on elements like gallium, germanium, and graphite.

- Strategic Need: Materials beyond rare earths, vital for advanced manufacturing and defence self-reliance, require new strategies to meet soaring global demand amidst environmental and geopolitical costs.

This session provided a comprehensive overview of the environmental risks associated with mining, including climate change-related risks, air/water pollution, and impact on biodiversity.

- Shifting Regulatory Landscape: Kazakhstan was highlighted as a regional leader in implementing international-aligned mining and subsoil reforms that are gradually shifting the sector away from legacy ‘pay-to-pollute’ models towards the use of best-available technologies.

- Circular Economy Solutions: Innovative approaches were showcased, including methods for generating income from mining waste, and utilizing decarbonisation frameworks.

- Technology for Transparency: The session explored tools like sustainable environmental assessments, and ‘mine to market’ traceability for effective risk mitigation and management.

The event concluded with Oxford University’s research on “Turning Brine into Value,” showcasing how oilfield brines, previously considered waste, can be transformed into profitable sources of elements like lithium, bromine, and rare earths – a proven technology ready for scale-up in Central Asian nations.

The MINEX Eurasia 2025 conference successfully brought together 135 participants, demonstrating a high level of engagement from senior-level professionals across the mining industry and related sectors.

The conference attracted a high concentration of senior delegates, with 75.56% of attendees classified as Decision Makers. This indicates a high value placed on the event by key industry stakeholders.

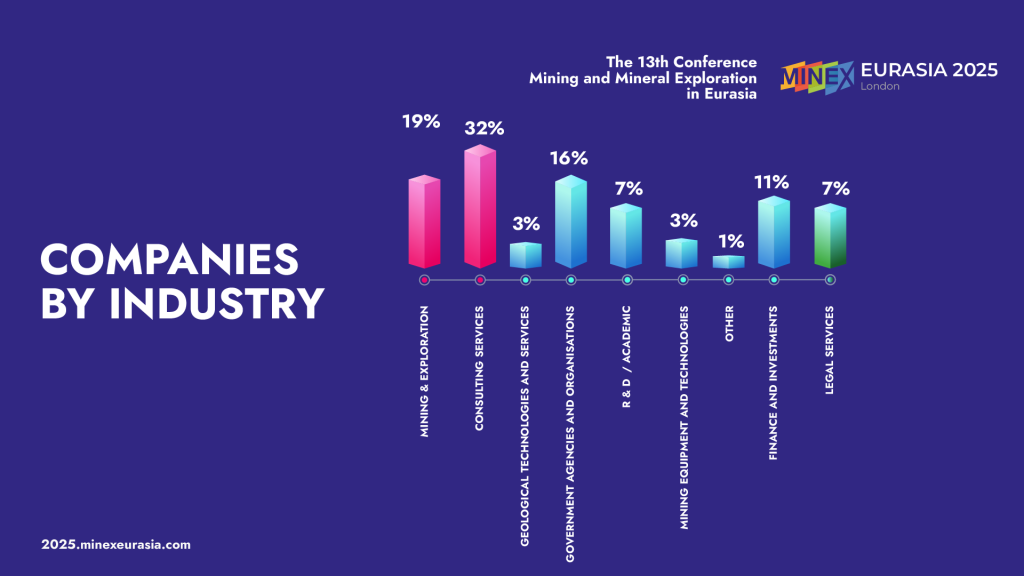

Participants represented a diverse range of company types, with the top three sectors being:

- Consulting services (31.85%)

- Mining & Exploration (19.26%)

- Government agencies and organisations (16.30%)

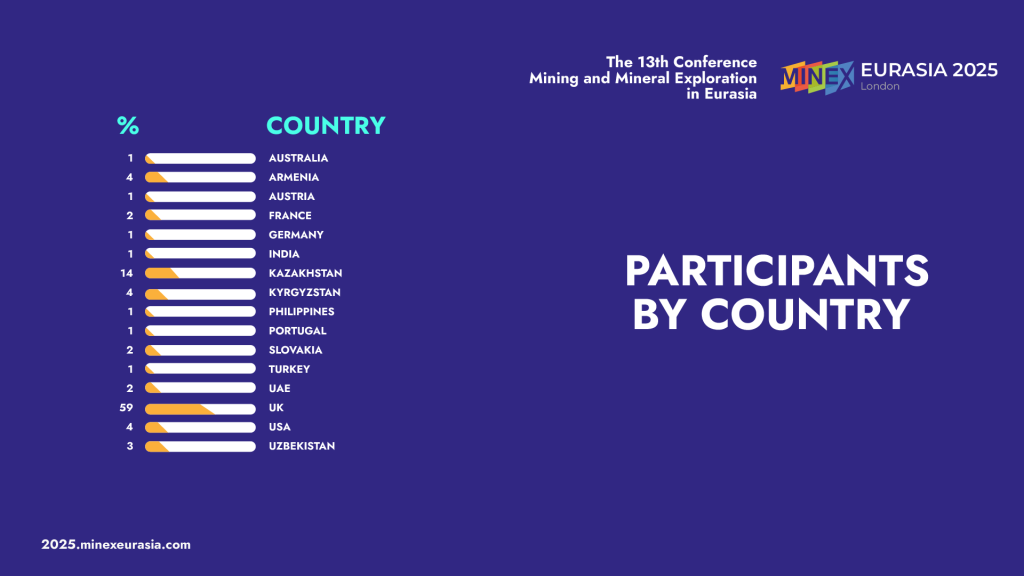

The conference had a strong international presence, drawing delegates from multiple countries. The top represented countries were:

- UK (59.26%)

- Kazakhstan (14.07%)

- Armenia, Kyrgyzstan, and the USA (each representing 3.70% of participants)